Take the next steps beyond customer self-service. Combine underlying customer data with AI/ML capabilities and intelligent automation to create revenue-generating customer journeys.

Bring components and connectors into other Mendix builds to get more projects finished faster.

Low-Code: Creating a Customer-Fueled Mortgage Experience

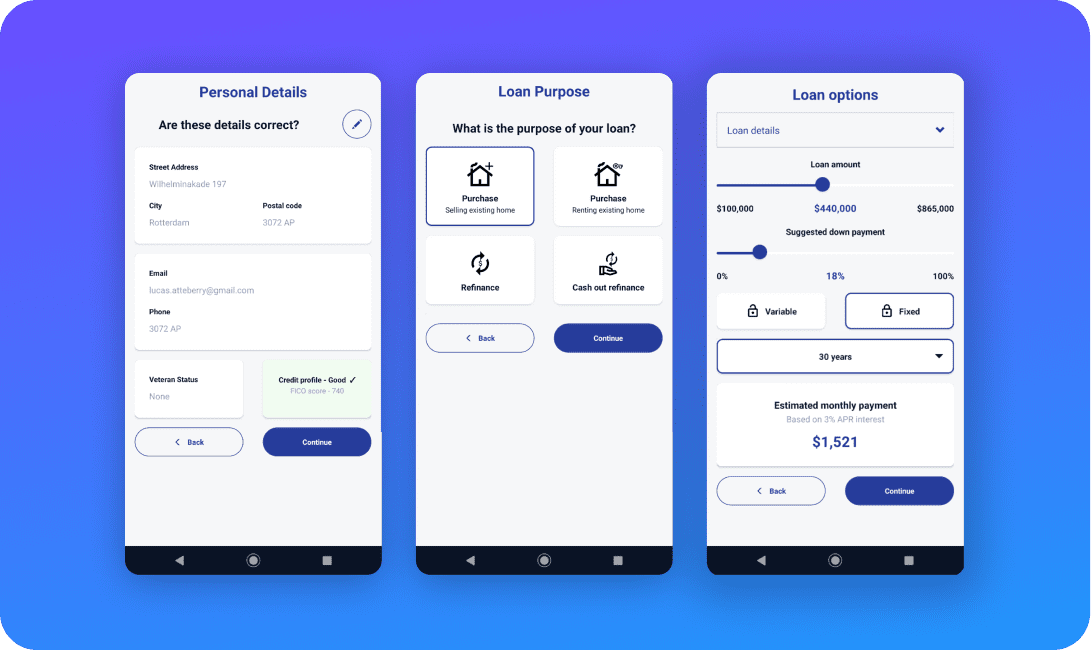

Streamlined Digitized Customer Workflow

Simplify the customer experience with a question-based workflow. Customers can validate their information, upload documents and engage OCR data processing, schedule time with a loan officer, print their pre-qualification letter, view their credit score, and e-sign. All that without ever leaving the application.

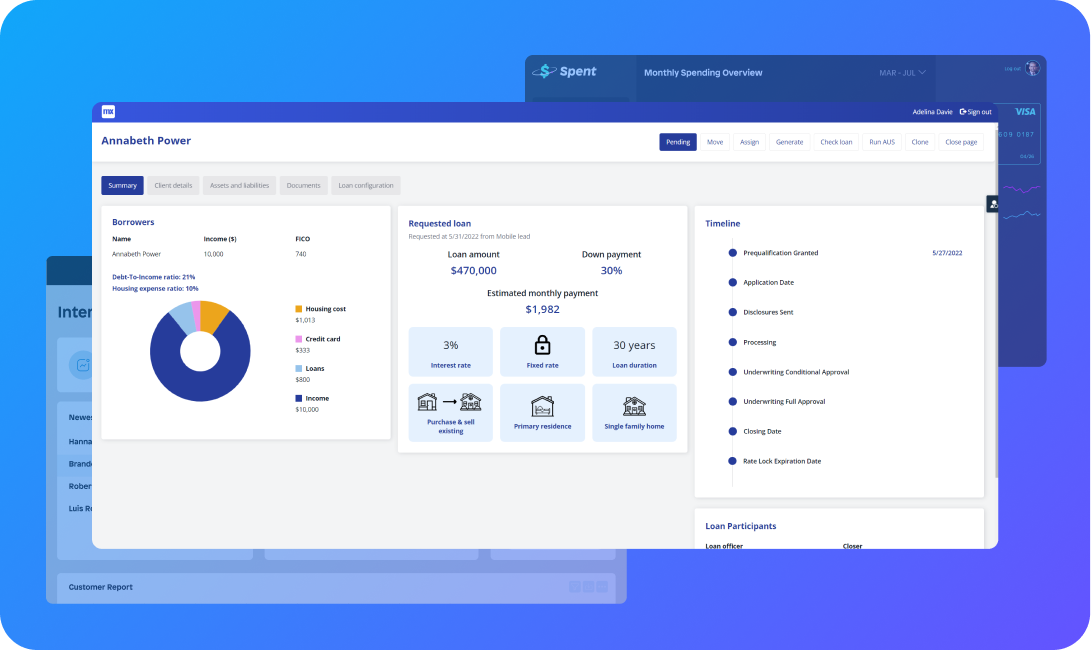

From Customer to Loan Officer–Seamlessly

No need to continue to Alt+Tab through the day–enable loan officers to close more loans with a custom-built solution that unifies CRM, POS, and LOS systems into a view that supports your organization’s sales process and policies.

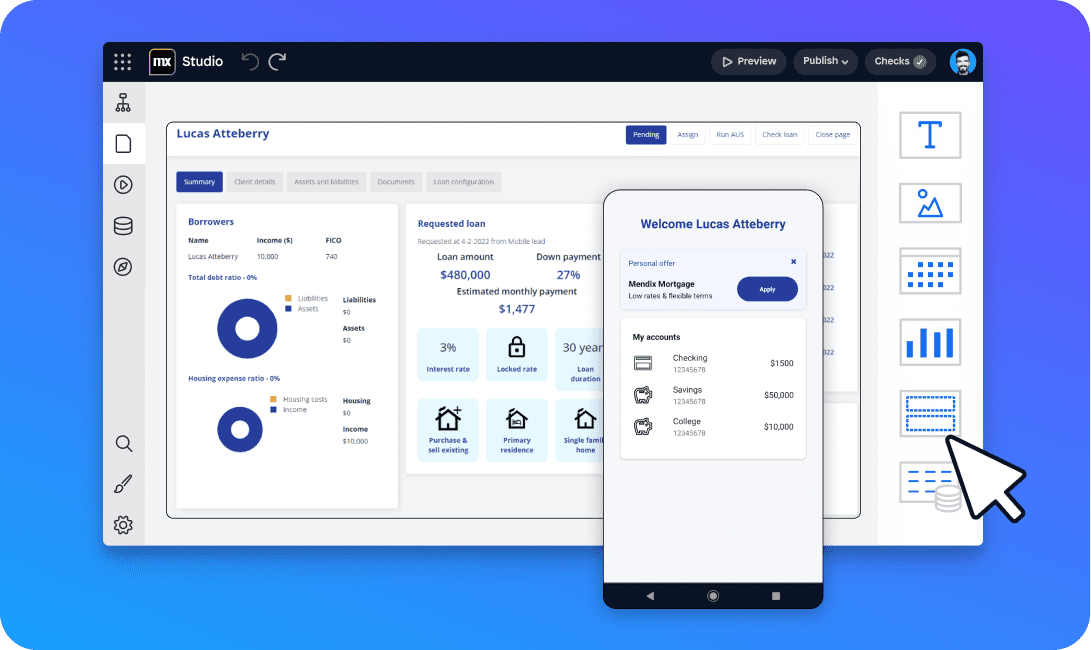

Powering Reusability

Build a component for one release and reuse it across other solutions and product offerings. Extend your governance and architecture and ensure your applications are maintainable and compliant. Save time, speed up deployment, get to market faster.

Mortgage Origination Application Capabilities

Use Case

Mendix: Streamlining Mortgage Experience

Using the Mendix low-code application development platform, Quion:

- Developed on online mortgage servicing portal with over 100 integrations in just six months

- Reduced telephone traffic by 37%

- Increased net promoter score (NPS) by 30 points

Ready to get started with this solution?

Fill this out and we'll reach out shortly.